Tristate AU Website

Here is what we have to say, check out latest technology news & Blog.

-

How to Choose the Right Payment Gateway ?

06 April , 2018Selecting the right payment gateways have become a crucial thing nowadays.

The competition of the online bizzo is increasing because of the increasing number of online buyers.

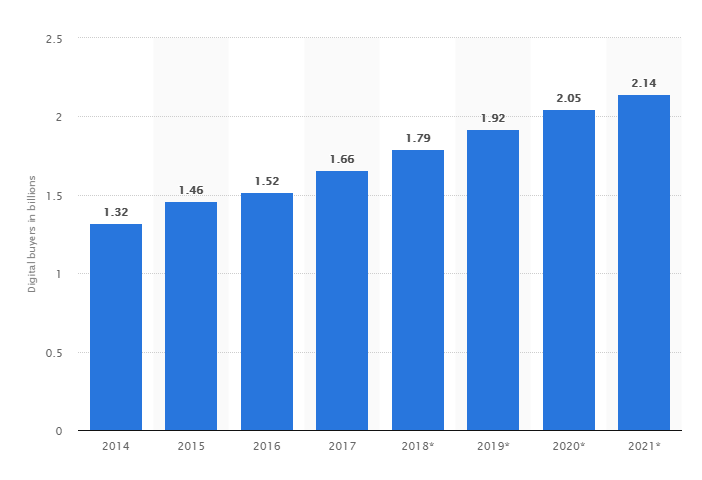

Let us have a look at the following stats that talk about the number of digital buyers from the year 2014 to 2021 across the world:

As per the above stats, more than 2.14 billion people across the world are expected to buy goods and services online. 1.66 billion people bought online in the year 2017.

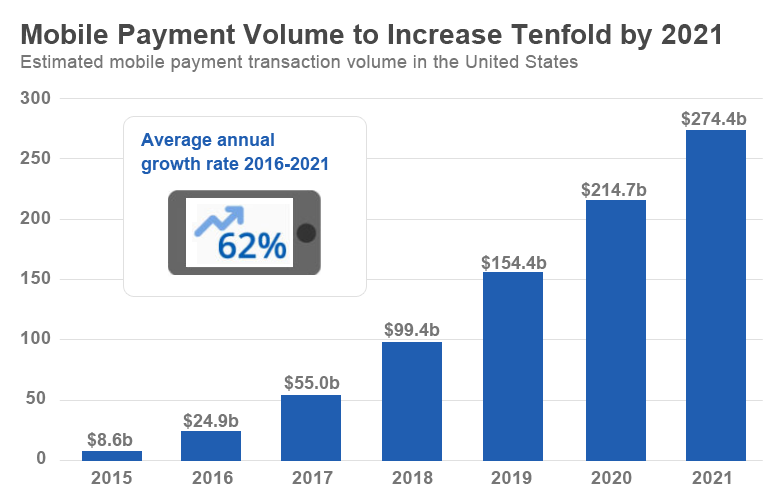

Also, let’s also see how mobile payments are increasing year on year. As per the research below, it is expected the mobile payment volume to reach up to USD 274.4 billion by the year 2021.

This is the reason why most eCommerce bizzo has started working on getting their mobile app an eCommerce one. Hence, the question arises –

How to Select to a Mobile Payment Gateway?

1.Perform Competitor Analysis

Before understanding your needs for payment gateway, you need to first look out at what your competitors are doing.

This industry has become too competitive because of doing things in just one go. So, competitor analysis becomes your 1st and foremost step, to begin with.

What all things you need to analyze in your competitors?

- Whether your competitor has the payment gateway integrated

- If yes to the above point, find out which one does they have

- Check out if any of their customers sharing their payment experience, the payment gateway hosting company, etc.

- In fact, before making an investment in mobile payment gateway, you can actually go and make a purchase on your competitors’ site (if that is possible)

Though, you have never read or heard of this step as an important aspect of before selecting any particular mobile payment gateway.

2.Look for Integration Options

Do you think payment gateways mean PayPal or Authorize.net?

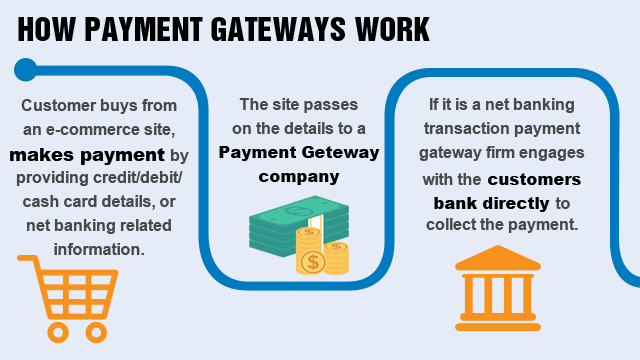

Well, the payment gateway is a place on your where your actual online transaction takes place without your presence. PayPal and Authorize.Net are the payment gateway service providers.

Here is an article that gives a detailed information on the types of mobile payment gateway options available:

1.Simple Checkout Method

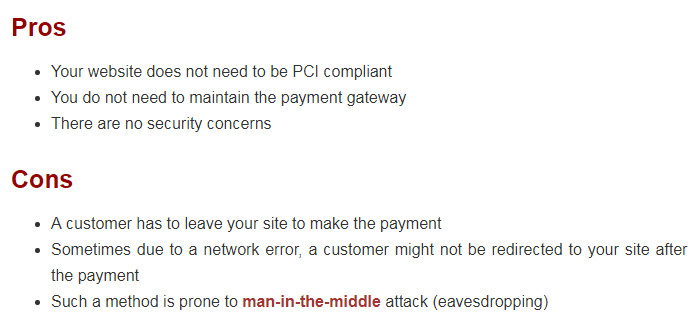

In this method, your user is transferred to the payment gateway service provider once he/she clicks on your “Buy Now” button. This integration method is considered to be the simplest of all. You don’t need to worry about any other topics that we are going to discuss here.

Well, this method is most feasible for the new entrepreneurs, paid subscriptions or even paid download forms.

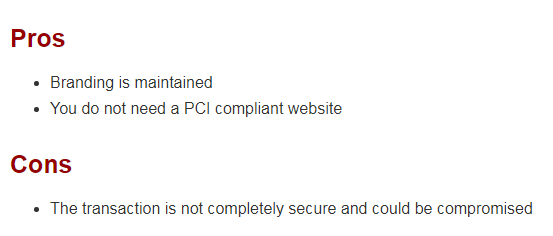

Check out the pros and cons of this simplest payment gateway integration method in the below image:

How to use this?

There are WordPress plugins from PayPal or other payment gateway service providers available that offer this method.

2.Direct Post Method

In this method, your web server takes all your customer information and transfers it to the secured payment gateway where the actual online transaction takes place. This means, the payment is not handled on your website and the customer data is taken care by the service provider.

It is said that this method helps improve your business reputation, as it served from your web server.

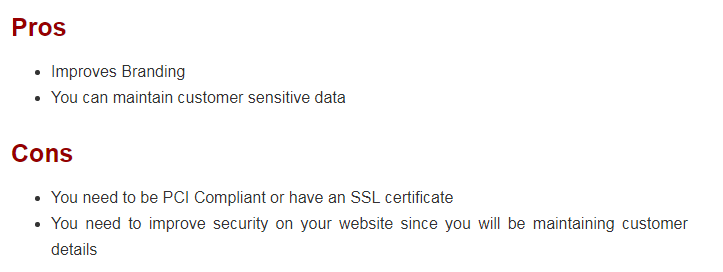

Understand the pros and cons of Direct Post payment gateway integration method in the below image:

How to use this?

Again, this can be used using WordPress plugins from well-known payment gateway service providers.

3.Server Integration Method

So, here in this method, the complete transaction is taken care by your website. Don’t worry, you don’t need to actually handle the payment processing and all. It will be done by the payment gateway service provider. But, for this, you need to be PCI compliant.

The customer data will be gathered from a form that is placed on your website. Once, the customer fills the data, it will be collected by the payment gateway service provider. Here, your customer will never come to know about a 3rd party hosting for online transaction. You will have the complete freedom to design your customer form and a thank-you page.

Most startups and SMEs take the advantage of this method.

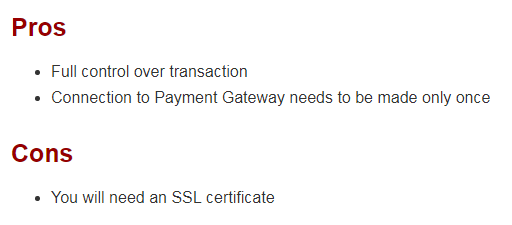

What are the pros and cons of this server integration method?

How to use it?

Sorry folks, there are hardly any plugins available that are easy-to-integrate into your website. Here, you would need the well-known payment gateway service providers such as PayPal, Authorize.Net, etc.

4.Advanced Integration Method

With this Advanced Integration Method, you have full control of your online transaction. So, you can design your own secured customer form to take their details on your website. Then, using a highly secured end-to-end SSL connection, an online can take place.

This method needs special design and configuration to be done on your website. And, this method looks too clean and professional.

Most of our customers at TriState Technology opt for Advanced Payment Gateway Integration Method for their web or mobile apps as this is way too technical, customized and secured.

So, following are the pros and cons of Advanced Integration Method (AIM) for payment gateway integration:

How to use it?

You can choose the best payment gateway development company to get this developed for you or you can even go for AIM plugins available in the WordPress.

So, based on all these above options available, you can always go for the best that suits your business, budget and branding. Else, we are just one click away to help you take the right decision for your bizzo.

So, irrespective of what integration method you choose, let’s understand what else do you need to consider before choosing the right payment gateway for your web or mobile app.

3.Ensure PCI DSS Compliance

The first and foremost step to select a payment gateway is to ensure the security of your customers’ data.

As per a research, around 95% of Americans are concerned about how companies use their data. Also, we discussed Gemalto’s research here in our latest blog on improving mobile app security, there is an increase of 13% of data breaches compared to the half year of 2016. So, this is definitely needs attention.

So, when you are planning to implement a payment gateway on your website, you need to be extra careful to offer highly secured online transaction. For this, your payment gateway needs to be PCI DSS compliant.

What is PCI DSS Compliance?

Payment Card Industry (PCI) Data Security Standards (DSS) is a set of security standard that ensures that Australian (OZ) bizzo like yours protect your customers’ card data and other information.

So, it becomes mandatory for you as well if you are looking to save, handle and transmit your customers’ card data.

Well, this will also depend on the type of integration method you choose as we discussed their pros and cons above.

4.Choose the Right Type of Gateway

What are the different types of Gateway?

1.Classic Gateway

Classic gateway comes with a compulsion to have a merchant account. A merchant account is required for those organisations that deal with the too large amount of online transactions on a routine basis. So, this could be useful for large enterprises.

The greatest benefit of a Classic Gateway is the per-transaction fee that is lower compared to the Modern Gateway. Examples of Classic Gateway include Authorize.net, WordPay and 2Checkout.

But, beware! It comes with a few challenges:

- Deployment of a Classic Gateway is not easy

- It takes a lot of time to deploy a Classic Gateway

- No integration flexibilities with API

2.Modern Gateway

You don’t need a merchant account if you want to deploy a Modern Gateway. It is directly linked to the bank account.

Compared to a Classic Gateway, Modern Gateway is way easier to set up. A few well-known Modern Gateway includes PayPal and Stripe.

A few challenges of a Modern Gateway:

- The per-transaction fee is too high of a Modern Gateway compared to a Classic one

- Redirect customers to the payment gateway service providers’ site that affects your transaction ratios.

Considering the type of gateway is also an important step towards selecting the mobile payment gateways.

5.Work on User Experience

Yes, user experience matters a lot when it comes to online payment.

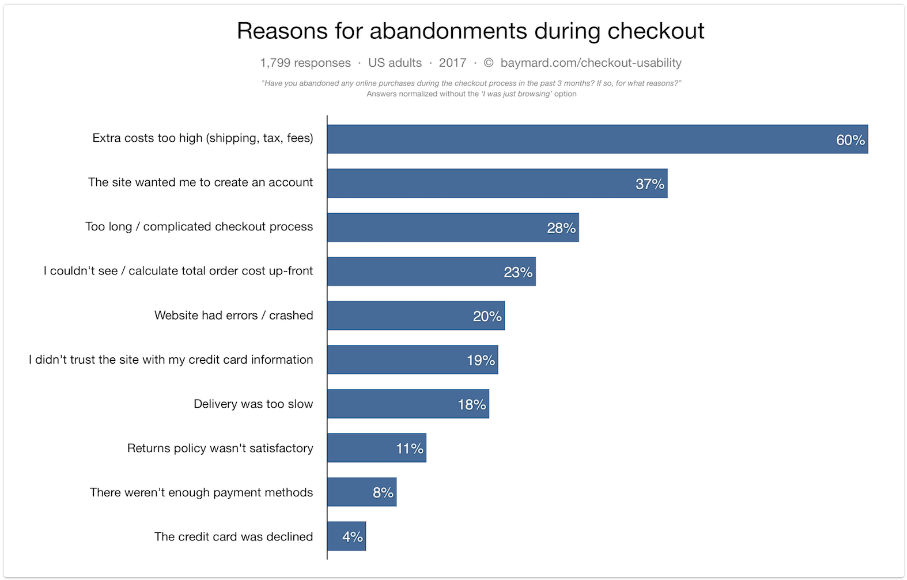

If you check out the above image, the 2nd and 3rd reason for card abandonment relate to user experience –

- The site wanted me to create an account

- Too long/complicated checkout process

So, you need to make sure that your payment gateway process is,

- Make sure it is secured

- Super easy to understand what the user needs to take action on the page

- Keep your form fields less

- Does your site redirect to 3rd party site? If yes, keep it uninterrupted

- Ensure the language is too personalised and engaging

6.Focus on Speed

Speed is an ultimate factor that the most internet users expect out of each of the websites they access on the web and even on the mobile. Google is also giving it so much importance.

But, speed does not remain constant when it comes to online transactions. Payment gateways use different technologies that affect the speed of their online transactions. Speed matters on how quickly you receive the amount at your end and how quickly the receipt is generated.

What are the challenges of payment gateway speed?

- Some gateways can’t process the online transactions quickly

- Some gateways get affected by the speed of the networks that they are connected to

But, still, it is matter to consider. So, focus on speed when it comes to selecting the appropriate mobile payment gateways.

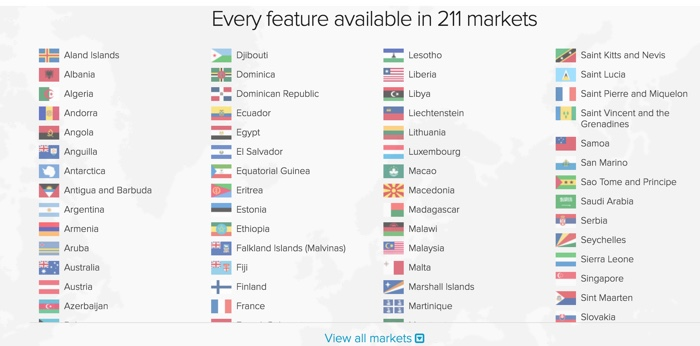

7.Finalize Countries to be Targeted

Which countries do you target for your business?

What are the well-known payment gateways in your targeted countries?

How your targeted audience prefers their online transactions to be taken care of?

All the above questions need to be answered by you before selecting a payment gateway.

Every industry is different and every audience has different habits, expectations and experiences. Based on them, you need to focus on selecting the right payment gateway.

If you plan to select a particular payment gateway and if it does not offer services in a few countries that you target, they shall be avoided and can be vice versa.

The idea here is not just implementing a payment gateway. The idea is to implement it successfully.

8.Consider Your Future Plans

So, just considering your present and past, it is not a wise decision to choose a mobile payment gateway.

Like we discussed in the beginning about the increasing trend of online purchasing, you need to consider what are your future plans with your bizzo in terms of upgrading to new technologies, trends, etc.

Based on this, you need to consider to select a mobile payment gateway. Changing your existing payment gateway is not at all a stress-free process. It would take not only your time and money, but, even your bizzo for that amount of transition time.

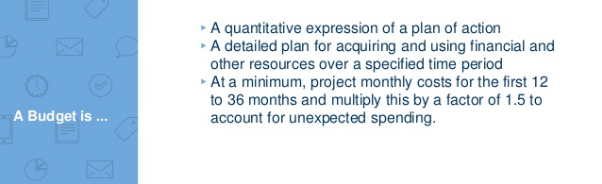

9.Watch Your Budget

One of the most important aspects to consider while selecting a web or mobile payment gateway – BUDGET.

You won’t compromise on security and UX, but, you would also look for your budget.

We just discussed about the type of gateway to select as it also differs from the per-transaction cost.

So, you need to identify the costs attached to and the answers to the following questions:

- o. of transactions that take place on your website or app

- How much constant your transaction volume will remain?

- What will be the average cost per transaction?

- What will be the payment gateway integration charges?

- Are you taking any other services from the provider?

- How will be the after sales support offered by the provider?

- What are their customers talking about their providers on the website and even on social media?

Calculate as many costs as you can before selecting a payment gateway. This will help you remain focused on your budget.

Final Thoughts

Selecting a mobile payment gateway needs a lot of research, planning and homework before jumping onto executing. As you know the trend of eCommerce business is increasing, you need to approach the right app development and payment gateway integration partner that will not just work on getting more bizzo, but, will help your bizzo grow exponentially.

-

The Best Features and Revenue Models for Travel App Development

August 11, 2023 -

Looking for the Best iOS App Development Framework? Know the Difference between SwiftUI and UIKit!

July 21, 2023 -

7 Mobile App Development Ideas that are Unique and Profitable

June 23, 2023 -

What is AngularJS? Why is it the Most Demanding Web Development Framework?

June 15, 2023 -

The New Era of Software Development is Here! 10 Latest Trends to Implement

May 30, 2023